For humans, making behavioral changes isn’t easy. And truthfully, most of us don’t try to improve ourselves or our finances out of the blue. There’s usually a specific reason, an event, or a guiding force that motivates us to change.

Maybe you just lost your job and realized your cash cushion isn’t as large as you’d like it to be. Or maybe it’s January 1, you’re riding the communal wave of self-improvement, and you decide this year you’ll build better money habits.

Another reason to add to the list? Financial Awareness Day on August 14. While it may sound like a made-up day (well, someone did make it up at some point), we’ll take it if it gives us another excuse to improve our finances.

Regardless of whether the holiday is “real,” why does being financially aware matter? Because being aware is THE first step to improving your financial health. How can you get to a better place financially if you don’t know where you’re starting from?

So to help you with this first, crucial step in improving your money matters, here are 4 ways you can increase your financial awareness, each in a different category of your finances (general finances, saving, credit, and spending).

1. Perform a SWOT Analysis (General Finances)

Before you dive into the nitty-gritty of your different financial accounts and documents, it’s best to start at a high level. An easy way to start this process is to answer the following question:

How would you describe your relationship with money? Understanding how you view and feel about money is important in addressing any underlying mental blocks or areas for improvement. Here are a few ideas to mull over so you can better answer that question:

- Is money something you avoid dealing with, talking about, or learning about?

- Does it make you angry or resentful?

- Is it a crutch for you? Something you think will rescue you from your problems?

- Are you completely disinterested in money?

- Is money something you feel unworthy of?

There’s no wrong answer. Just be sure to write down how you’d describe your relationship with money today—not what you wish it were. That way you can have a clear sense of what’s working and what may not be.

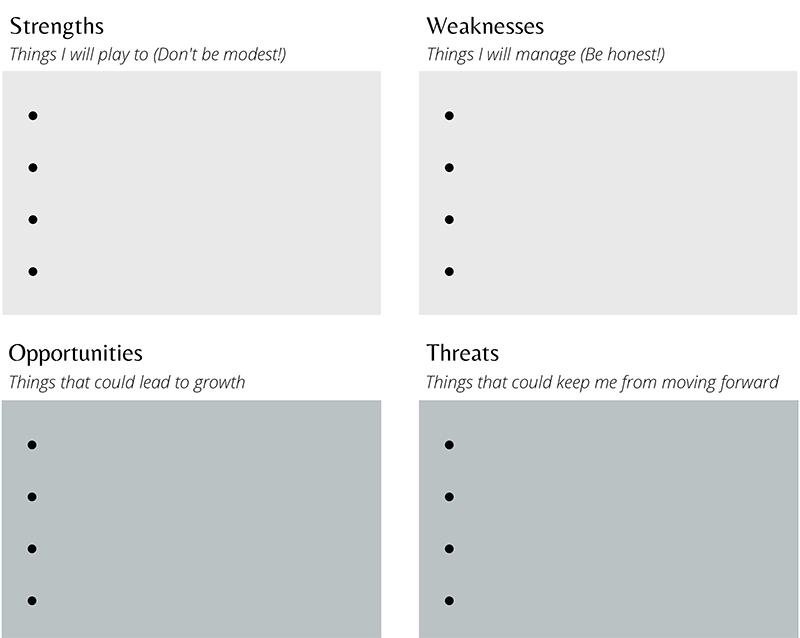

Next, perform what’s called a SWOT analysis, where you write down your financial Strengths, Weaknesses, Opportunities, and Threats. Here’s a simple chart you can use as a starting point:

Performing a SWOT analysis with the above template can help you learn more about where you are financially today and how you can get to where you want to be.

By giving yourself an opportunity to reflect, you can build a much stronger path forward for becoming the best version of your financial self.

2. Define What Wealth Means to You (Saving)

Saving is one of the most important elements of your personal finances. But before you dive into how much you should be saving and which accounts to move your funds into, you’ll need to take a step back.

Research shows that when we have a clear motivation for our goals (A.K.A. we’ve defined the why behind our goals), we’re more likely to achieve those goals. One study even found that having a sense of purpose is tied to increased income and net worth!

To clarify your motivations for saving, many financial experts will encourage you to write down concrete goals (I’m saving $50,000 so I can buy a house next year; I’m saving so I can retire early, etc.).

But it’s important to peel this layer back even further. WHY do you want to buy a house? WHY do you want to retire?

That’s why we recommend you get clear on what wealth *actually* means to you. It can be different for everyone, depending on interests, stage of life, and personal values. But for most people, true wealth is ultimately about freedom.

Wealth can mean freedom from money, time, relationships, or spiritual and physical challenges.

To help you build a strong foundation for WHY you’re saving and building wealth, write down your answers to the following questions:

- What is my personal definition of wealth?

- Do I have an “abundance” mentality or “lack” mentality?

- What is holding me back from accumulating more wealth?

- What am I most excited about in having wealth?

Once you have the “WHY save?” covered, the “HOW and WHAT to save?” will become much clearer.

3. Know How the “Lending Gods” View You (Credit)

Taking on debt is a necessary part of living—it’s how most of us are able to get an education or buy a home. And the way we can get more favorable terms for taking on that debt? Having a healthy credit score. (Bonus: Managing your debt well can also help you build your credit.)

Your credit rating can affect your ability to get favorable loans: it can affect whether you’re qualified, the amount you can receive, and the interest rate.

Your credit score is based on these main criteria, listed in order of importance:

- Payment History (Are you paying bills and other obligations on time?)

- Credit Utilization (Are you using less than 30% of your available credit?)

- Length of Credit History (Do you have accounts that have been open for a while?)

- Mix of Credit Types (Do you have a good balance of installment accounts and credit card accounts?)

- Recent Applications (Has it been a while since you’ve had a hard inquiry into your credit?)

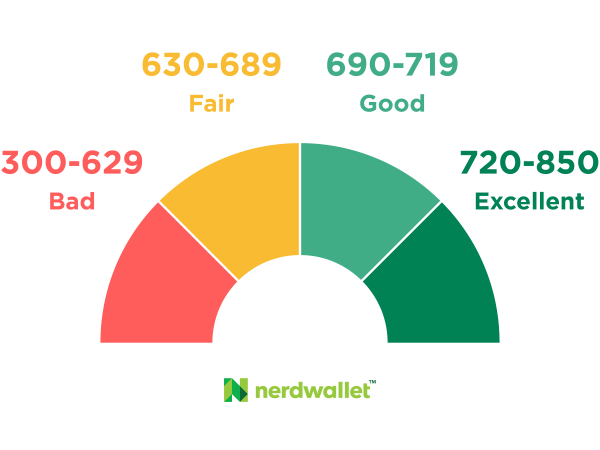

A higher number indicates stronger credit. Generally, loan applicants with a higher credit rating can qualify for larger loan amounts with lower interest rates. Image from nerdwallet.com.

Being aware of your credit score is crucial for your financial health. You can check your score regularly through free apps like Mint or Credit Karma. When you keep tabs on your credit score, you’ll be able to spot areas for improvement, notice anomalies, and make plans for your future.

Next, get back to the WHY for improving your credit by answering these questions:

- What are some big future purchases that will require loans?

- Why are these important to me?

- What adjustments will I make to take these on? (Ideas on what you’re willing to pay, what cost you’ll take on, or what you’ll give up to make room for these loans.)

4. Identify Your Spending Habits and Triggers (Spending)

When you think about your finances, you may quickly start thinking about how much you’re spending. Having control of your money isn’t necessarily about spending less—it’s about spending smartly.

Smart spending is something we talk about frequently at Willow. It means how you spend is in line with what you value, as well as how much money you have and are bringing in.

The exercise below is an easy way to think about your spending and how it is (or isn’t) supporting your values.

In thinking about your spending habits, answer the following questions with Always, Sometimes, or Never:

Part 1

- I pay myself first with automated transfers to savings. (Always / Sometimes / Never)

- I save my bonus cash and spare change. (Always / Sometimes / Never)

- I regularly review my credit card statements. (Always / Sometimes / Never)

- I plan for big purchases. (Always / Sometimes / Never)

- I plan my meals and make grocery lists. (Always / Sometimes / Never)

- I pay bills early or on time. (Always / Sometimes / Never)

- I set aside “money for fun” each month. (Always / Sometimes / Never)

- I don’t let anyone convince me to buy things I don’t need or can’t afford. (Always / Sometimes / Never)

Part 2

- I utilize promotions that give bigger discounts the more I spend. (Always / Sometimes / Never)

- I spend more than I was planning to qualify for free shipping. (Always / Sometimes / Never)

- I spend more to get credit card rewards. (Always / Sometimes / Never)

- I buy something I may not need just because it’s on sale. (Always / Sometimes / Never)

- I grocery shop without a list or plan. (Always / Sometimes / Never)

- I don’t pay bills on time. (Always / Sometimes / Never)

- I shop for stress relief. (Always / Sometimes / Never)

- I spend on items I don’t really want or need because I’ve seen others make the purchase. (Always / Sometimes / Never)

If you answered with a lot of “Never” in Part 1, OR a lot of “Always” in Part 2, it might be time to re-evaluate some of your spending habits. Make a goal to ensure your healthy spending habits (Part 1) are more pervasive than your not-so-healthy spending habits (Part 2).

Next, it’s time to think about what can trigger your spending. When you think about purchases you’ve made that you regret later on, what do you notice?

- It happens before / during / after ________________________ [insert event(s)].

- It happens at _________________________ [insert physical location(s)].

- It happens when I’m feeling __________________________ [insert emotion(s)].

- It happens when I’m with ____________________________ [insert person/people].

When you become aware of your spending habits and triggers, you’ll feel more in control of your spending—not the other way around—and have a better picture of where your money is going.

Don’t Skip Through This Stage the Next Time You’re Re-evaluating Your Finances

When you’re ready to revise your finances—whether it’s January 1 or August 14—you may be tempted to jump right into money tactics and strategies. But when you start with these crucial steps of becoming financially aware, you’ll be better set up for success. So take the time in each category of your finances to understand exactly where you’re at and why it matters to you to improve. It’ll make your plan-building, follow-through, and likelihood of completion that much stronger.